Efficient Digital Lending Processes

CreditFlow and AutoInsights enable more efficient SME credit processes for lenders: benefit from digital and automated workflows – and offer your customers a better experience.

CreditFlow and AutoInsights: Our Solutions for the Challenges of SME Lending

SME customers want digital interactions and require fast processing of their credit applications. As a lender or broker, you also benefit from digitizing your lending processes. With CreditFlow and AutoInsights, you overcome bureaucracy and administrative burdens. Instead, you create more time for your front and back office to focus on what really matters: working with and for your customers.

Outdated Processes and IT Systems

Enable SME customers to apply for financing digitally – and stand out from the competition.

Administrative Burdens

Use digitization and automation to free up your employees’ time.

Poor Customer Experience

Accelerate the process – Teylor Technologies enables you to approve loans within 48 hours.

Skilled Labor Shortage

Automate administrative tasks in your lending process – and create more time for your front and back office to work for customers.

Our Solutions at a Glance

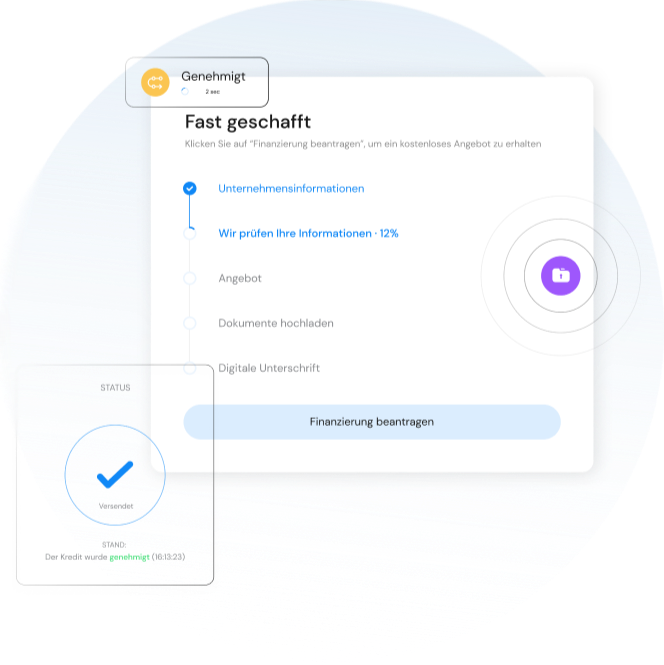

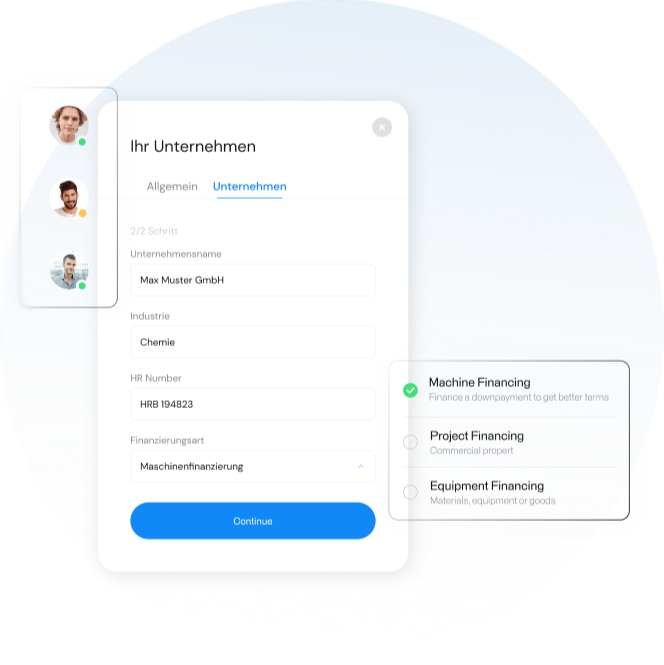

Digital Loan Application

CreditFlow

- Apply for loans digitally in under 10 minutes

- Loan approvals within 48 hours on average

- Always be informed about the current application status

- Service-oriented customer experience

- Modular and configurable application interface and workflows

- End-to-end solution: fully digital from sending a request to concluding a contract

With CreditFlow, financial institutions can expand their reach through digital channels, improve their customer experience, and target the steadily growing group of online-savvy customers. Customers submit their request via a digital application interface and a customer portal, enter all the necessary information themselves, and upload the relevant documents. Front- and backoffice staff use an advisor portal to digitally process incoming requests.

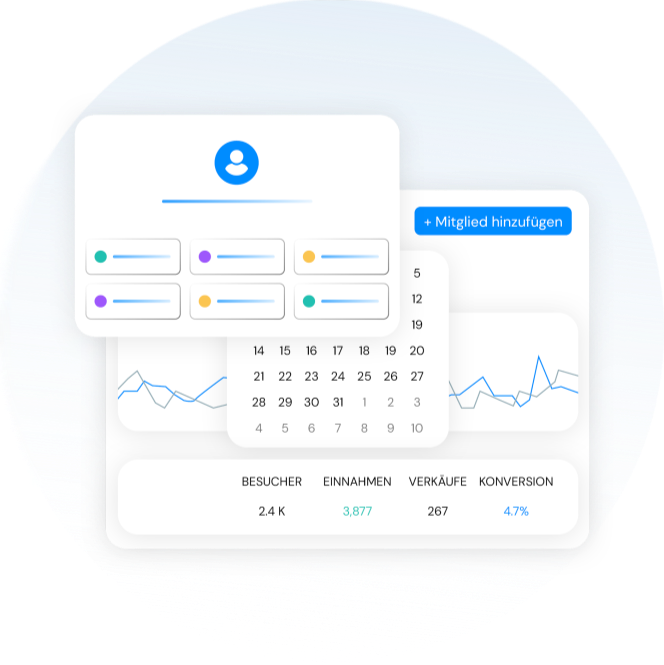

More Time for Core Tasks

AutoInsights

- Digital document management

- Quick lead qualification

- Automated balance sheet analysis

- Comprehensive company reports

AutoInsights frees up time for your front and back office to focus on their core tasks. The solution replaces manual processes with digital document management and an automated business analysis. Quick lead qualification enables quick decision-making. Balance sheet analysis is performed automatically and all information is summarized in a company report. AutoInsights is the ideal solution for customer acquisition, lead qualification, and customer communication.

AutoInsights is a browser-based SaaS solution. It does not require complicated integration into core banking systems – instead, financial institutions directly benefit from the added value of this solution.

Added Value Along the Entire Lending Process

From digital financing requests to support for existing customers: lenders and brokers can digitize various tasks and improve the efficiency of SME lending with the solutions provided by Teylor Technologies.

This Is What Our Customers Say

This Might Also Interest You

Let's Chat!

You are interested in digitizing your lending process or have questions about our solutions? Schedule a free consultation now – we are happy to advise you.

tc@teylor.com