Digital Loan Application with CreditFlow

Small and medium-sized enterprises expect digital processes that enable quick and efficient financing. However, a majority of financial institutions do not offer digital financing solutions yet.

With CreditFlow, you as a lender can digitize your application flow to create a more efficient lending process.

CreditFlow Ensures Efficiency and Optimizes the Customer Experience

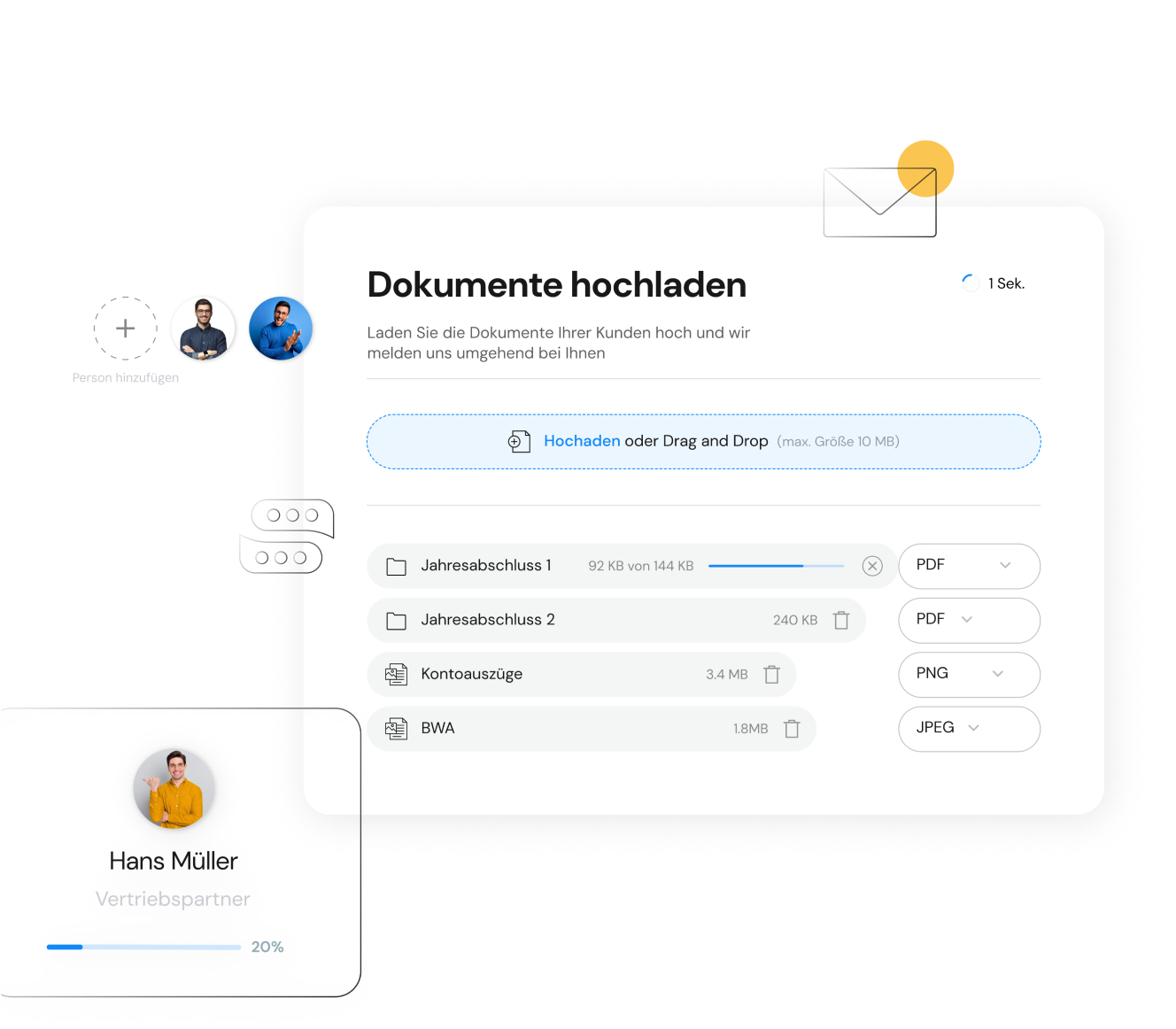

SME customers submit their loan application digitally with CreditFlow. They enter all relevant information into a customer portal and upload the necessary documents. Contracts are prepared and signed digitally, too. Front- and backoffice advisors use an advisor portal in which they process requests quickly and efficiently.

With CreditFlow, banks lower their operative costs, improve customer satisfaction, and increase their competitiveness.

Benefits of a Digital Loan Application

Lower operating costs

Raise credit volume

Improve customer satisfaction

Increase competitiveness

Financing Request

Digital Financing Request: Customer Focus Meets Efficiency

Your customers can request SME financing with CreditFlow via a digital white-label application interface. You can serve different customer segments with a dynamic modular system and offer different credit products.

Customer Portal

Advisor Portal

Digital Financing Request: Customer Focus Meets Efficiency

Your customers can request SME financing with CreditFlow via a digital white-label application interface. You can serve different customer segments with a dynamic modular system and offer different credit products.

Practical Insights: How Financial Institutions Work With CreditFlow

From financing requests to leasing applications: There are many different ways to use CreditFlow. Our use cases provide an overview of how financial institutions work with our solution in practice.

This Might Also Interest You

Let's Chat!

You have questions about CreditFlow or are interested in digitizing your loan application process? Schedule a free consultation now – we are happy to advise you.

tc@teylor.com