Purchase financing

Access additional liquidity to finance commercial purchases without delays.

Purchase financing

Companies often face the challenge of having to order products or materials quickly without having sufficient liquidity. This lack of liquidity can jeopardise ongoing operations and limit opportunities for growth. With Teylor purchase financing, we offer you a flexible and fast solution to secure your purchases and keep your business running smoothly.

By using purchase financing, you can stabilise your supply chain, take advantage of favourable buying conditions and optimise your inventory management. This enables you to react flexibly to market changes and leverage your growth potential. Our customised financing options help you to improve your liquidity and avoid operational bottlenecks.

Your advantages with Teylor purchase financing

- Fast & digital process: Our fully digital process enables fast processing and payout of your financing within one to two business days. This shortens the waiting time for urgently needed funds and allows you to react quickly to market opportunities.

- Immediate liquidity: Get the funds you need to order products or materials immediately without interrupting your operations. This helps you to avoid production downtime and keep your business running smoothly.

- Flexible repayment options: Choose the repayment terms that best suit your business model and cash flows. Our flexible financing options allow you to structure payments to best support your financial needs and capabilities.

- Attractive conditions: Thanks to our extensive network of financing partners and the Teylor credit fund, we offer you the best conditions on the market. This ensures that you benefit from competitive interest rates and favourable financing conditions.

- Tailored advice: Our experts will advise you on the best financing options and guide you throughout the entire process. You benefit from our expertise and experience to develop the optimal financing strategies for your company.

- Inventory management: Purchase financing contributes to optimising your inventory management by reducing high one-off payments and enabling better liquidity management. This ensures that you always have the necessary materials and primary products to fulfil your production requirements.

- Negotiating power: By providing the necessary liquidity, you can strengthen your negotiating position with suppliers and benefit from better purchasing conditions. With sufficient financial resources, you will be able to negotiate larger quantities at better prices and build long-term partnerships with your suppliers.

- Continuous production: Statt auf Liquidität aus dem operativen Betrieb zu warten, können Sie ohne Produktionsunterbrechnung sofort Vorprodukte und Waren einkaufen und mit der Produktion fortfahren. Dies gewährleistet eine kontinuierliche Produktion und hilft, Engpässe zu vermeiden, die die Lieferzeiten und die Kundenzufriedenheit beeinträchtigen könnten.

- Seasonality: By procuring goods and preliminary products ahead of time, you can maximise profits from seasonal business such as Christmas sales. Timely purchase financing enables you to cover seasonal peaks and benefit from increased sales volumes.

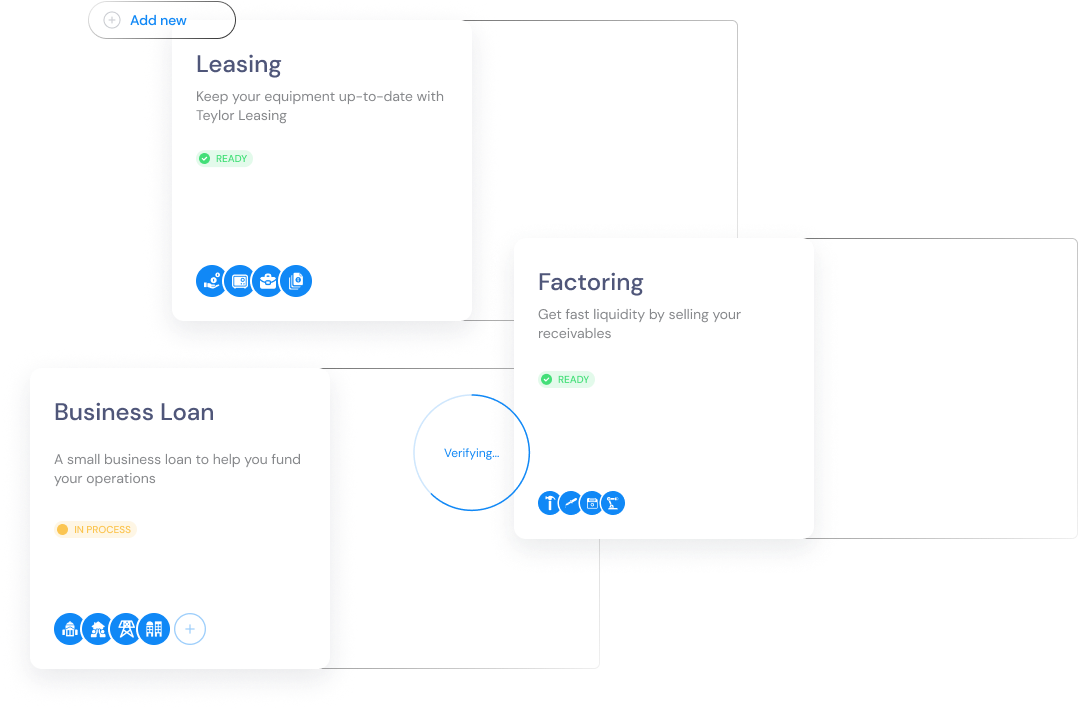

How the application works

- Apply in minutes: Complete our simple online application and receive a non-binding offer immediately.

- Non-binding offer: The offer is customised and includes indicative borrowing terms. You will receive this offer online and free of charge.

- Upload documents: Upload the required documents online. We will treat your data securely and confidentially.

- Identification and digital signature: Identify yourself using video legitimisation and sign the contract digitally.

- Payout: We will check your documents and transfer the invoice amount to your account within one to two business days.

Examples of purchase financing

- Production: Finance the purchase of raw materials and primary products to keep your production running smoothly. Solid purchase financing enables manufacturing companies to react to price fluctuations on the raw materials market and purchase large quantities at favourable conditions. This improves production planning and reliability, avoids bottlenecks and increases efficiency. You can also invest in modern machinery and technologies to increase product quality and production capacity.

- Retail: Secure the funds you need to replenish stocks and ensure your ability to deliver. Retailers can use purchase financing to optimise their stock levels and ensure that they are able to deliver at all times. This is particularly important in times of high demand or seasonal fluctuations. With access to sufficient funds, you can place larger orders at better prices, thereby increasing your profit margins. Financing also allows you to add new product lines to your range quickly and flexibly.

- Services: Invest in the materials and equipment you need to provide your services without interruption. Service companies benefit from purchase financing by being able to keep their supplies and equipment up to date. This is crucial for the quality and continuity of the services offered. Whether it's IT equipment for a software company, tools and materials for craft businesses or medical equipment for healthcare providers, purchase finance allows you to continually renew and improve your working capital without draining your liquidity.

- Construction industry: Use purchase financing to procure the building materials required to complete construction projects. By securing financing, construction companies can complete projects on time, avoid material shortages and negotiate better terms with suppliers. This leads to greater efficiency and profitability of construction projects.

- Agriculture: Finance the purchase of seeds, fertilisers and agricultural equipment to maximise your crop yields. Purchase financing helps farmers cover their operating costs and invest in modern technologies that increase productivity and efficiency. This allows you to better manage weather-related risks and capitalise on market opportunities.

- Retail: Use purchase financing to source seasonal and trend-driven products in a timely manner and keep your shelves well stocked. This enables retailers to respond quickly to market trends, maximise sales opportunities and increase customer satisfaction. Financing allows you to place larger orders and benefit from volume discounts, improving profit margins.

- Healthcare: Invest in medical equipment, drugs and consumables to ensure high quality patient care. Purchase financing enables healthcare providers to regularly replenish their stocks and invest in modern technologies without straining liquidity. This helps to improve the quality of treatment and patient satisfaction.

Take advantage of Teylor purchase financing and secure the funds you need for your purchases. Submit your application today and experience how quick and easy purchase financing can be.

FAQ on purchase financing

- What is purchase financing and how does it work? Purchase financing is a short-term financing option that enables companies to procure goods and materials without draining their liquidity. The invoice is paid by the financier and the company pays the amount back in instalments at a later date.

- What advantages does purchase financing offer companies? Purchase financing improves liquidity, enables better purchasing conditions, stabilises the supply chain and helps to exploit growth opportunities. It also facilitates inventory management and strengthens the negotiating position with suppliers.

- What types of purchases can be covered by purchase financing? We finance a wide range of purchases, including raw materials, intermediate products, materials, inventory, as well as specific industry requirements such as IT equipment, medical equipment or construction machinery.

- How long does it take to process an application for purchase financing? Thanks to our fully digitalised process, you will receive an indicative offer within a few minutes. Once all the necessary documents have been submitted, the final approval and payment is made within one to two business days.

- Can small companies also benefit from purchase financing? Yes, our purchase financing solutions are flexible and can be customised to the needs of companies of any size. For small and medium-sized enterprises (SMEs) in particular, Teylor financing offers fast and simple access to liquidity.

- What costs are associated with purchase financing? The costs depend on various factors, including the financing amount and financing term as well as the creditworthiness of your company. Our conditions are competitive and transparent in order to offer you the best solutions.

- What security requirements are there for purchase financing? Depending on the creditworthiness and financial stability of your company, different types of collateral may be required.

- Which sectors particularly benefit from purchase financing? Industries such as manufacturing, trade, construction, services, agriculture, retail and healthcare benefit particularly from purchase financing. Each industry has specific requirements that are covered by our customised financing options.

- How does purchase financing influence my supplier relationships? By providing the necessary liquidity, you can strengthen your negotiating position with suppliers and benefit from better purchasing conditions. You can negotiate larger quantities at better prices and build long-term partnerships.

- Are there special conditions for seasonal purchases? Yes, we offer flexible repayment options for seasonal purchases that are tailored to the specific requirements of your industry and seasonal fluctuations. This enables optimal liquidity management during peak seasons.

Requirements & Documents

Check the requirements below to see if you are eligible for a loan

What are the minimum requirements?

If you don't meet these minimum requirements, we will not be able to provide you any kind of financing.

The company is registered in Germany

The company's revenue in the last financial year was at least 50,000 €

The company has been active since at least two years

What documents do you need?

You can upload your documents online on our website or send them via email to your financial consultant at info@teylor.com.

The annual reports of the previous two financial years (meaning if you apply in 2022, we need reports from 2021 and 2020)

An up-to-date 'Betriebswirtschaftliche Auswertung' with 'Summen- und Saldenliste (no older than three months)

Bank account statements of the last three months (not older than 14 days)