Efficient Digital Lending Processes

The Teylor Technologies platform enables more efficient SME credit processes for lenders: benefit from digital and automated workflows – and offer your customers a better experience

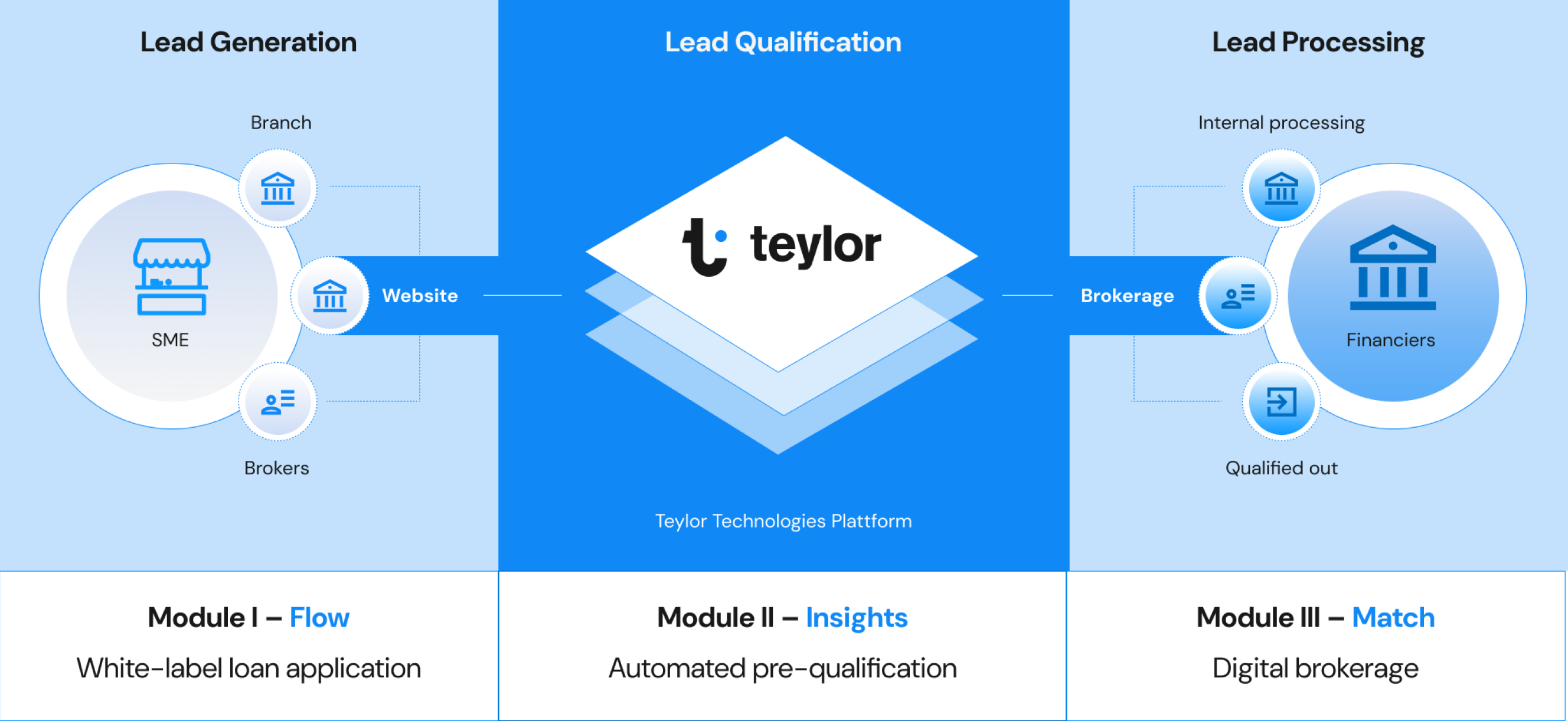

One Platform, Three Modules: Our Solutions to the Challenges of SME Lending

Your customers expect digital accessibility, fast decisions, and transparent processes. With the Teylor Technologies Platform, lenders and brokers manage the entire credit journey – from lead generation to processing – efficiently, digitally, and with the customer in focus.

All modules work seamlessly together

Building on the base module Teylor.Insights – all other solutions are interoperable and use shared data structures. All modules are designed to build on each other enabling end-to-end digital processes from application to placement.

For example, loan requests generated via Teylor.Flow can be directly qualified in Teylor.Insights. If yia the Insights module a lead is determined to not match the lender’s own portfolio criteria, the system can automatically hand it over to Teylor.Match for onward placement – including all available data, documents, and scoring results.

Typical Challenges in the SME Lending business:

Outdated Processes and IT Systems

Enable SME customers to apply for financing digitally – and stand out from the competition.

Administrative Burdens

Use digitization and automation to free up your employees’ time.

Poor Customer Experience

Accelerate the process – Teylor Technologies enables you to approve loans within 48 hours.

Skilled Labor Shortage

Automate administrative tasks in your lending process – and create more time for your front and back office to work for customers.

Our Solutions at a Glance

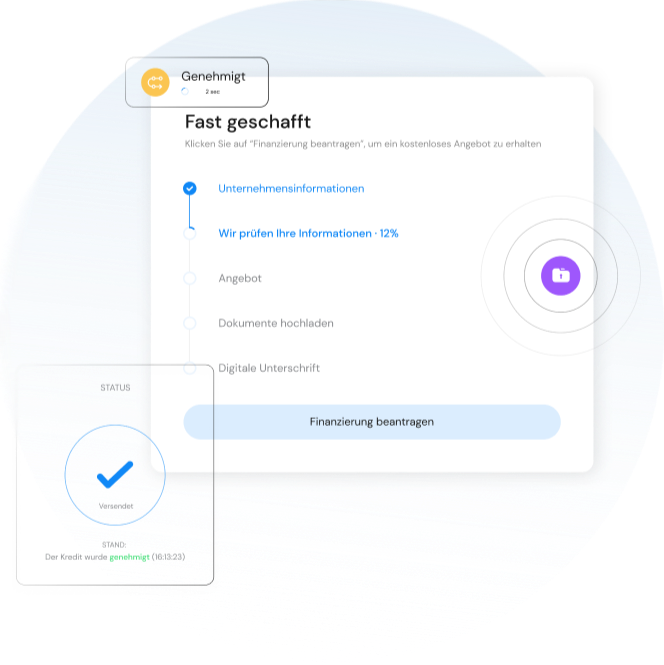

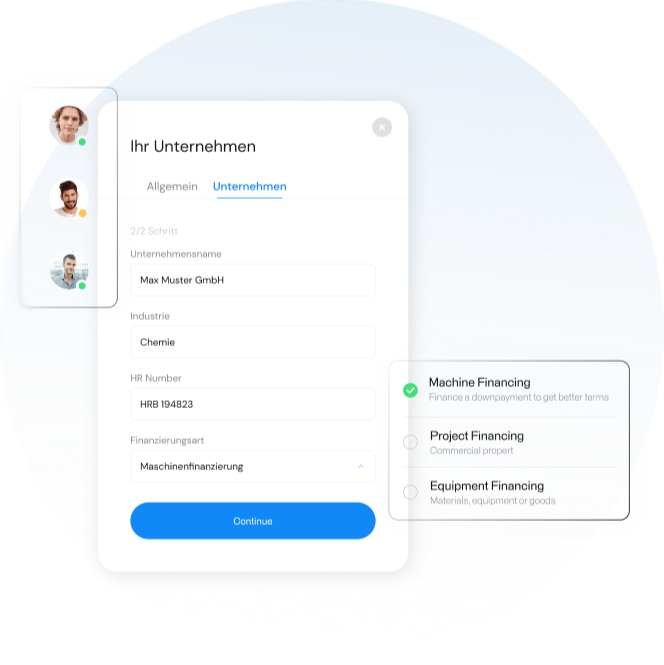

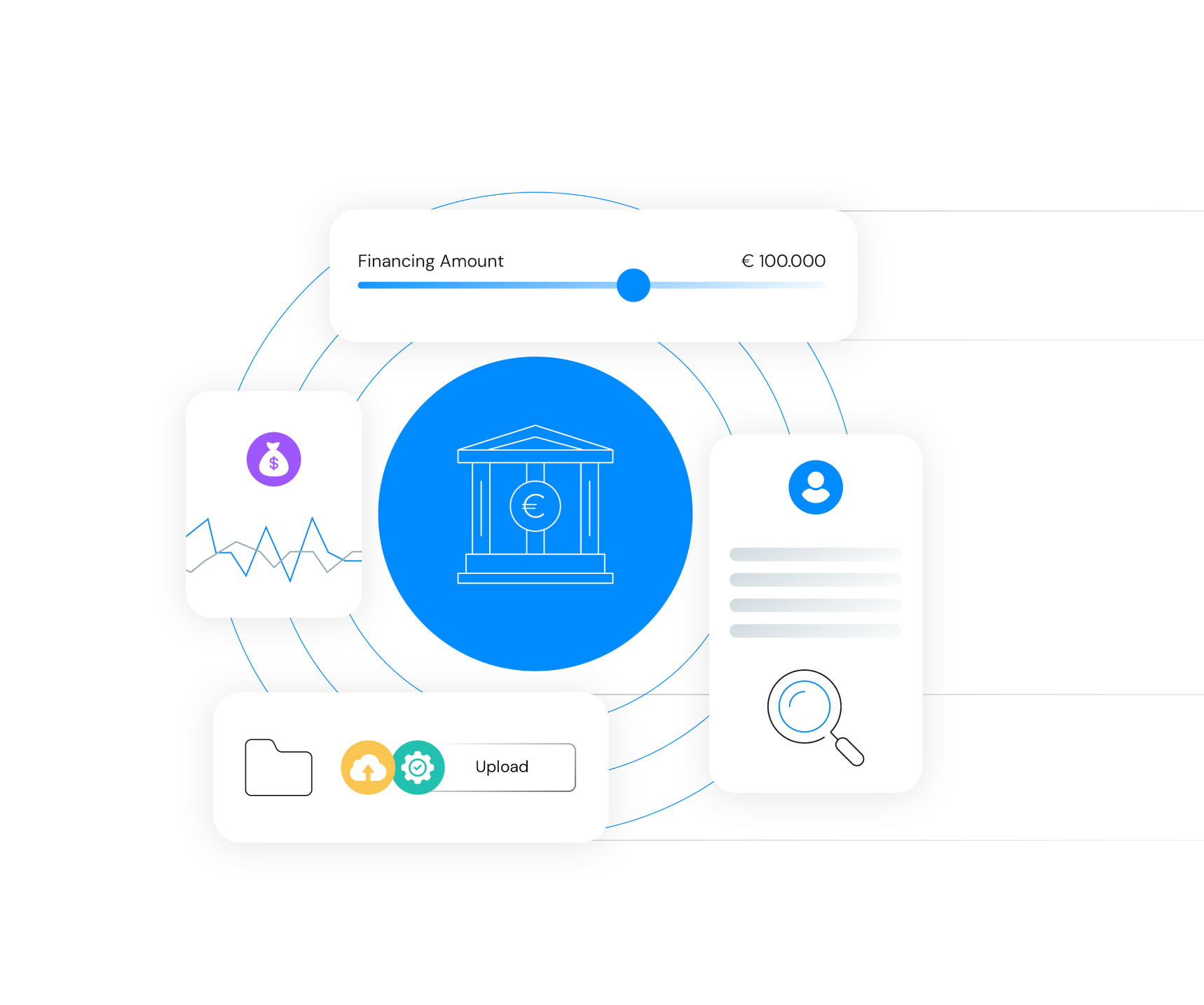

Digital Loan Application

Teylor.Flow

- Apply for loans digitally in under 10 minutes

- Loan approvals within 48 hours on average

- Always be informed about the current application status

- Service-oriented customer experience

- Modular and configurable application interface and workflows

- End-to-end solution: fully digital from sending a request to concluding a contract

With Teylor.Flow, financial institutions can expand their reach through digital channels, improve their customer experience, and target the steadily growing group of online-savvy customers. Customers submit their request via a digital application interface and a customer portal, enter all the necessary information themselves, and upload the relevant documents. Front- and backoffice staff use an advisor portal to digitally process incoming requests.

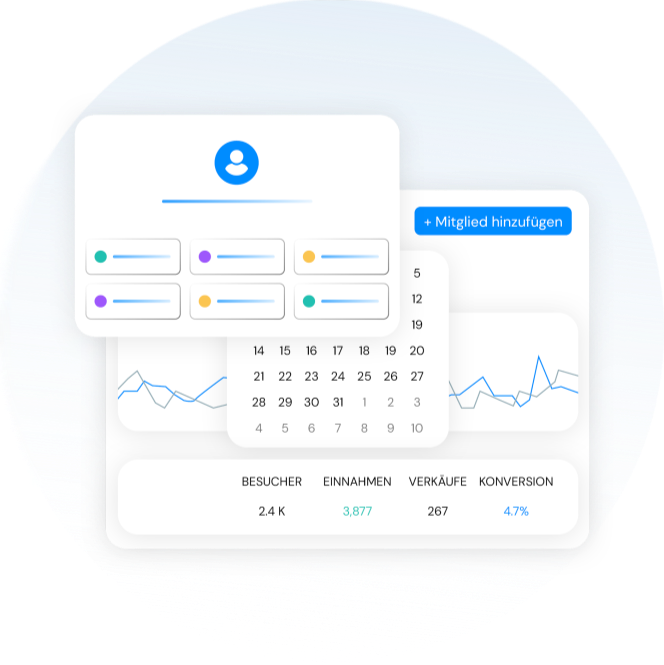

More Time for Core Tasks

Teylor.Insights

- Digital document management

- Quick lead qualification

- Automated balance sheet analysis

- Comprehensive company reports

Teylor.Insights frees up time for your front and back office to focus on their core tasks. The solution replaces manual processes with digital document management and an automated business analysis. Quick lead qualification enables quick decision-making. Balance sheet analysis is performed automatically and all information is summarized in a company report. Teylor.Insights is the ideal solution for customer acquisition, lead qualification, and customer communication.

Teylor.Insights is a browser-based SaaS solution. It does not require complicated integration into core banking systems – instead, financial institutions directly benefit from the added value of this solution.

Digital Brokerage

Teylor.Match

- Digital placement with +20 partner financiers – banks, leasing companies or factoring providers

- Automated matching based on predefined acceptance criteria

- Automated price indications

- Digital customer and partner interaction

Match optimizes the intermediary business between lenders, brokers, and financing partners. The solution automates the matching of loan requests with the acceptance criteria of connected partner banks and financiers. Price indication, document requests, and partner communication are handled digitally and in real time – enabling smooth and seamless selection of suitable financing solutions. Teylor.Match reduces manual coordination, increases conversion rates, and accelerates the entire intermediation process.

Added Value Along the Entire Lending Process

From digital financing requests to support for existing customers: lenders and brokers can digitize various tasks and improve the efficiency of SME lending with the solutions provided by Teylor Technologies.

This Is What Our Customers Say

This Might Also Interest You

Let's Chat!

You are interested in digitizing your lending process or have questions about our solutions? Schedule a free consultation now – we are happy to advise you.

tc@teylor.com