Inventory financing

How to finance goods, raw materials and supplies, protect your liquidity and secure your supply chains. Find out more!

Inventory financing

Inventory financing is a type of corporate financing that aims to finance the purchase of goods, raw materials and supplies. This enables companies to manage their supply chains and inventories efficiently without burdening their liquidity. By accessing capital to finance purchases, companies can optimise their business processes and increase their competitiveness.

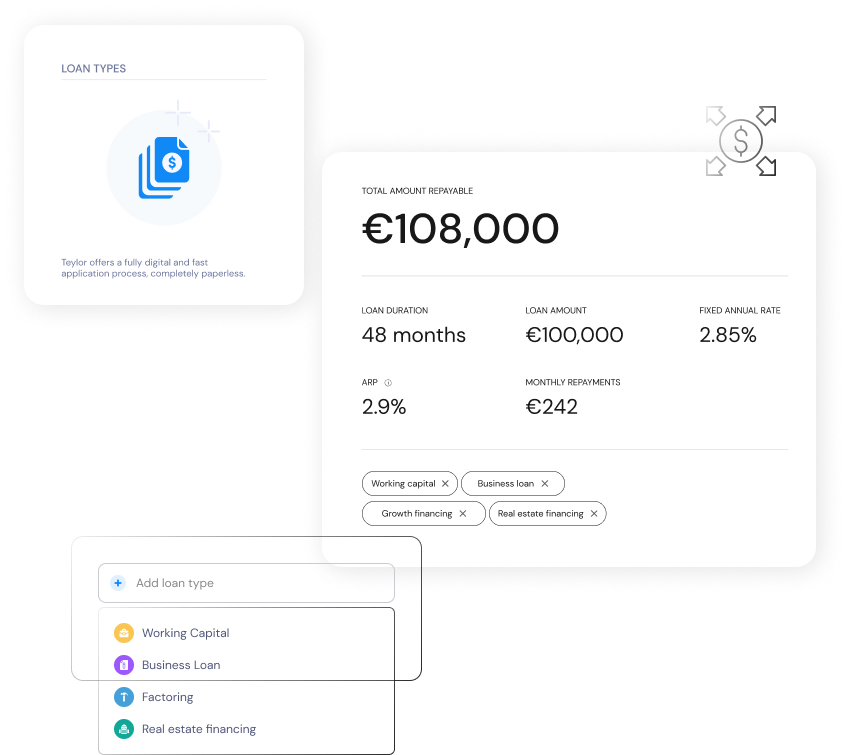

Teylor offers customised loans for inventory financing that are specifically tailored to the needs of small and medium-sized enterprises (SMEs). With our fully digitalised application process and fast turnaround, we ensure that you get fast access to the funding you need.

The advantages of inventory financing with Teylor

- Fast & digital process: Our digital processes enable us to process your applications quickly and provide financing within one to two business days. You will receive a non-binding offer immediately and can complete the entire process conveniently online.

- Customised solutions: We offer flexible solutions that are tailored to your company’s needs and business requirements. Our solutions are designed to offer you maximum financial flexibility.

- Attractive conditions: Thanks to our extensive access to different financing options and our industry experience, we get you the best offer.

- Personalised advice: Our experts will guide you through the entire process to advise you on the best financing solution for your company. Benefit from our expertise and experience to make the best decisions for your company.

Examples of inventory financing in various industries

- Production: A furniture manufacturer regularly needs large quantities of wood, fabrics, and other materials to maintain its production. Through inventory financing, they can buy these raw materials in advance without draining liquidity, ensuring constant production and avoiding costly stops.

- Retail: A clothing retailer needs to replenish stock in time for the autumn and winter season to meet seasonal demand. Inventory financing enables the retailer to order a large selection of winter clothing and keep it in stock, maximizing sales opportunities and increasing turnover during the high season.

- Wholesale: Inventory financing is critical for wholesalers who regularly process large orders. Financing large quantities of goods without draining liquidity allows them to negotiate better purchasing conditions and benefit from discounts, thereby increasing profit margins.

- Construction industry: A construction company needs building materials and specialized equipment regularly. By financing these materials, they can ensure that all necessary resources are available to continue projects without interruption, improving project planning and increasing customer satisfaction.

- E-commerce: An online retailer of electronics must keep popular items like smartphones and laptops in stock to quickly respond to demand fluctuations. Inventory financing allows them to flexibly replenish stock, ensuring readiness to deliver, improving customer satisfaction, and strengthening their market position.

- B2B: Inventory financing is crucial for B2B companies that need to keep large quantities of goods and materials in stock to meet ongoing customer needs. It enables efficient inventory management and stable supply chains without draining liquidity, which is key for maintaining long-term business relationships and responding to larger orders.

Financing of inventory in online stores with SME e-commerce business loans

Financing inventory is particularly important for e-commerce companies. Online retailers often have to pre-finance large quantities of products in order to remain competitive and be able to react quickly to fluctuations in demand. Inventory financing in e-commerce enables these companies to optimise their inventories and at the same time protect their liquidity. This is crucial to be successful in the dynamic and fast-moving e-commerce market.

The advantages of inventory financing in SME e-commerce:

- Ability to react quickly: Inventory financing allows e-commerce retailers to quickly replenish their stocks to react to sudden changes in demand or seasonal fluctuations. This prevents supply bottlenecks and ensures a high level of customer satisfaction.

- Competitive advantage: With sufficient inventory financing, e-commerce SMEs can offer attractive promotions to win customers and secure market share.

- Liquidity management: By maintaining their liquidity, e-commerce SMEs can invest their capital in other growth drivers such as marketing, technology, and attracting talent.

- Negotiating power: With the ability to pay supplier invoices immediately, e-commerce SMEs can negotiate better terms and discounts, improving margins and reducing costs.

- Scalability: Inventory financing supports the growth of e-commerce companies by providing the financial flexibility to expand into new product lines or markets without jeopardising their financial stability.

With Teylor inventory financing, e-commerce SMEs can organise their business models more efficiently and achieve sustainable growth. Our customised financing options are specifically designed to meet the needs of online retailers and help them achieve their goals.

How the application works

- Apply in minutes: Complete our simple online application and receive a non-binding offer immediately.

- Non-binding offer: The offer is customised and includes indicative borrowing terms. You will receive this offer online and free of charge.

- Upload documents: Upload the required documents online. We will treat your data securely and confidentially.

- Identification and digital signature: Identify yourself using video legitimisation and sign the contract digitally.

- Payout: We will check your documents and transfer the invoice amount to your account within one to two business days.

Take advantage of Teylor inventory financing and take your business to the next level. Make your application today and experience how easy and fast financing your goods can be.

FAQ on inventory financing

- What is inventory financing and how does it work? Inventory financing is a form of corporate financing that is specifically aimed at financing the purchase of goods and raw materials. The financier provides the necessary capital so that companies can make their purchases without draining their own liquidity. This enables efficient management of supply chains and inventories, which in turn optimises operational processes and increases competitiveness.

- What inventory can be financed? We finance a wide range of goods, including raw materials, intermediate and finished products, as well as inventory for e-commerce, retail and wholesale SMEs. We also finance materials such as metals, plastics and textiles, as well as finished products such as clothing, electronics and furniture and more. Our wide range of financing options enables us to tailor our offer to the needs of your business.

- How does inventory financing affect my liquidity and supplier relationships? Inventory financing protects your liquidity and keeps your supply chains stable. This enables you to pay supplier invoices immediately, which enables you to benefit from better conditions and discounts. Inventory financing improves your negotiating power and contributes to the long-term stability of your supplier relationships.

- Which sectors particularly benefit from inventory financing? Inventory financing is particularly beneficial for companies in e-commerce, retail, B2B and wholesale. These industries benefit from the ability to finance large order quantities without draining their own liquidity. This enables them to negotiate better purchasing conditions, manage their stock efficiently and react flexibly to fluctuations in demand.

- How long will it take to process my application? Thanks to our fully digitalised process, you will usually receive an indicative offer within a few minutes. Once all the required documents have been submitted, final approval and payout will take place within one to two working days. Our efficient and transparent processing ensures that you can access the funds you need fast and easily.

- Can I also submit the application by phone? Yes, our customer service is also available by phone to support you with your application for inventory financing. Our experts will advise you and help to complete the application. By providing personalised support over the phone, we can respond to your individual questions and make the entire process as smooth as possible for you. We are at your side from the initial enquiry to the final payout and beyond.

- Is there an upper limit for inventory financing? No, we offer flexible financing options without a fixed limit. Our solutions are customised to your needs and the size of your inventory. Whether you want to finance small quantities or large inventories, our financing options are scalable and offer you the flexibility you need to achieve your business goals. This adaptability allows us to support projects of any size and ensure that you get the funding you need.

- How secure is my data? We treat your data securely and confidentially. We use the latest encryption technologies to protect your information. Your security and the protection of your data is a top priority for Teylor. We implement strict security protocols and work continuously to secure our systems against unauthorised access. We also meet all relevant legal data protection requirements and adhere to the highest standards in data processing to ensure that your information is safe and secure.

Requirements & Documents

Check the requirements below to see if you are eligible for a loan

What are the minimum requirements?

If you don't meet these minimum requirements, we will not be able to provide you any kind of financing.

The company is registered in Germany

The company's revenue in the last financial year was at least 50,000 €

The company has been active since at least two years

What documents do you need?

You can upload your documents online on our website or send them via email to your financial consultant at info@teylor.com.

The annual reports of the previous two financial years (meaning if you apply in 2022, we need reports from 2021 and 2020)

An up-to-date 'Betriebswirtschaftliche Auswertung' with 'Summen- und Saldenliste (no older than three months)

Bank account statements of the last three months (not older than 14 days)